Overview

The Element Resource Funds

The Element funds invest in small to mid-cap resource companies across base, industrial and precious metals, coal, bulks, uranium and the oil & gas sectors.

Investment Preference

Element invests in quality projects that have the potential to be developed into, low cost mines that can be sustained throughout the commodity price cycle.

Investments can be made through the development spectrum, from early stage explorers to producers. A strong focus is on expansion capital opportunities to take mining projects through feasibility, development and production stages.

Global Focus

The Funds have a global investment mandate by have a strong preference for Australian based management.

Market Conditions

Recent volatility in equity markets combined with a maturing commodities cycle requires careful management and investment selection as well as the ability to access and structure attractive investments in order to outperform the market.

It is on this basis that the Fund has been established, specifically to provide investors with continued strong returns from the resources sector in a maturing market using the capabilities of a proven fund manager.

Strategy

Investment Size

The investment size will be up to $20 million, subject to the funds constitution, which may occur in staged investment.

Partnership Investments

Larger investments can be made in conjunction with Partnership Investment Funds who are interested in co-investment opportunities.

Risk Management

Element has a strong focus on risk management in the investment decision process and thereafter using tailored investment structures appropriate for the risk and opportunities, staged investments and active portfolio management.

Investment Structures

Investments are structured to reflect the risks and opportunities associated with each investment opportunity. Structures include equity, direct equity, debt, hybrid securities and other structures. Whilst these investments will generally be made in publicly listed entities (across global markets), they may include private transactions.

Investment Process

Preliminary desktop review . Discussions with management and preparation of an indicative term sheet, if the opportunity meets the funds investment’s criteria. Detailed due diligence including site visits, technical, operational, financial, legal and country specific issues. Review by specialist external consultants if required. Finalisation of term sheet and submission to our Investment Committee for approval to invest. Preparation of legal documentation once the investment is approved.

Value Add

Skillsets

Element seeks to invest in projects and companies that can provide superior rates of return. Element can provide its complimentary technical, financial and legal skillsets to help portfolio companies achieve this.

Management

Respected within the industry, Element’s management team has served on portfolio company boards.

Contacts

Element’s experience and networks in the global mining and financial industries, Element frequently provides useful contacts and introductions to assist portfolio companies achieve their goals.

Performance Record

| Period | Average Compound Return | |

| Fund 1 | 1997 – 2002 | 30.00% |

| Fund 2 | 2003 – 2004 | 38.37% |

| Fund 3 | 2005 – 2008 | 33.29% |

| Fund 4 | 2005 – 2007 | > 30.00% |

| Fund 5 | 2011 – 2014 | > 65.00% |

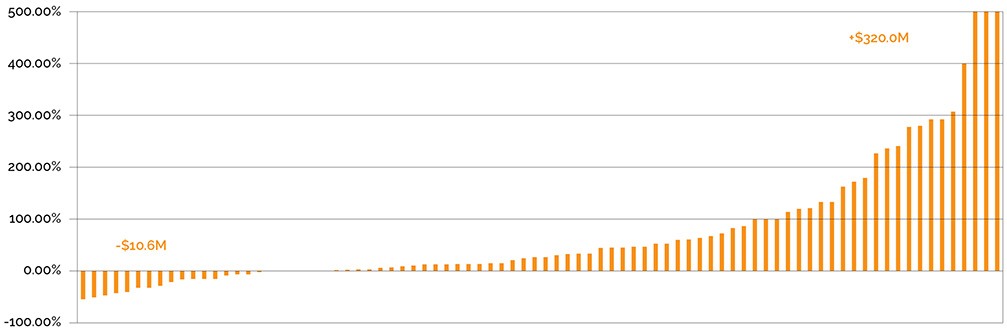

Picking Winners